ΑΣΦΑΛΙΣΗ ΥΓΕΙΑΣ ΠΟΥ

ΣΟΥ ΔΙΝΕΙ ΠΕΡΙΣΣΟΤΕΡΑ

Ένας σύμβουλός μας είναι πάντα στην διάθεσή σου

ΜΑΘΕ ΠΕΡΙΣΣΟΤΕΡΑ >

Νιώσε σίγουρος ότι κάποιος είναι δίπλα σου καθημερινά από την πρόληψη έως και την τριτοβάθμια περίθαλψη με το Οικοσύστημα Υγείας & Φροντίδας Life On. Σχεδίασέ το πάνω στις δικές σου ανάγκες, επιλέγοντας τις καλύψεις σου, συγκρίνοντας τα κόστη και παραμετροποίησέ το για μια ολοκληρωμένη προστασία και φροντίδα κάθε στιγμή!

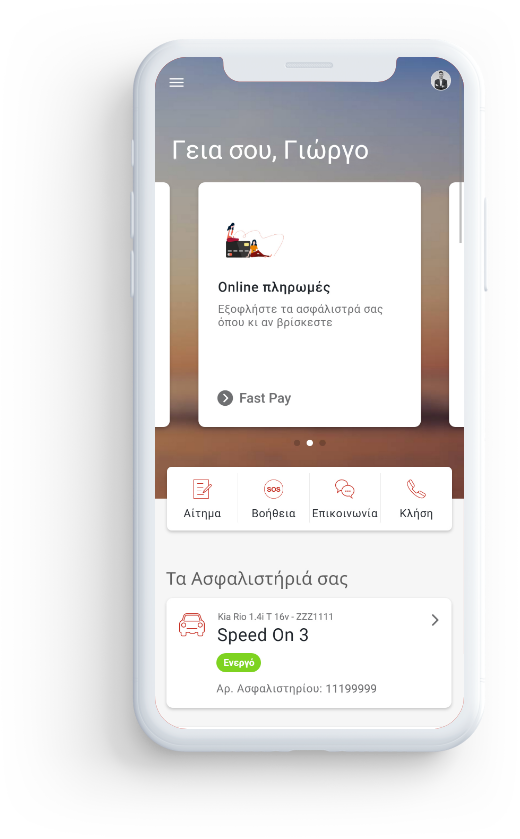

Απόλαυσε τις διαδρομές σου με ολοκληρωμένες καλύψεις και προσωποποιημένες υπηρεσίες που σε επιβραβεύουν για την καλή οδηγική σου συμπεριφορά με χαμηλότερα ασφάλιστρα. Σχεδίασε το δικό σου πρόγραμμα ασφάλισης Speed On με βάση τις ανάγκες σου και κέρδισε πολλά περισσότερα από παραδοσιακές καλύψεις.

Ζήσε ξέγνοιαστα στο σπίτι σου και απόλαυσε κάθε μικρή ή μεγάλη στιγμή, γνωρίζοντας πως κάθε τι προστατεύεται από το πρόγραμμα ασφάλισης κατοικίας Home On. Με πλήρη κάλυψη και με έξυπνες υπηρεσίες για άμεση εξυπηρέτηση και τεχνική αποκατάσταση, το Home On διασφαλίζει την ηρεμία σου και την καθημερινότητά σου στο 100%.

Δώσε ώθηση στα μελλοντικά σου σχέδια με ένα πρόγραμμα σαν το Maximizer. Νιώσε σίγουρος ότι οι αποταμιεύσεις σου θα διασφαλίσουν το καλύτερο αύριο που επιδιώκεις με πρόσθετες καλύψεις για προστασία από έκτακτα γεγονότα και μεγιστοποίηση την απόδοση των χρημάτων σου με διαφορετικές επενδυτικές επιλογές & συστηματική αποταμίευση.

Ταξίδεψε και μείνε ήσυχος ότι τίποτα δεν θα διαταράξει τη διαδρομή και τον σκοπό του ταξιδιού σου με την Ασφάλιση Ταξιδιού Fly Away. Είτε, λοιπόν, ταξιδεύεις για προσωπικούς είτε για επαγγελματικούς λόγους, το Fly Away διασφαλίζει ολοκληρωμένη κάλυψη για οποιαδήποτε ζημιά, απώλεια ή καθυστέρηση παρουσιαστεί στο ταξίδι σου.

Επίλεξε τη δική σου διαδρομή και προστάτεψε τον τρόπο που έχεις διαλέξει για να μετακινείσαι, εξασφαλίζοντας κάθε τι που μπορεί να συμβεί με το ποδήλατό σου ή και στο ποδήλατό σου με το πρόγραμμα ασφάλισης Cycle Away. Νιώσε σίγουρος με μία ευρεία γκάμα καλύψεων.

Κάνε τις αποδράσεις σου από την καθημερινότητα ακόμα πιο ονειρικές, γνωρίζοντας πως έχεις διασφαλίσει κάθε τι που μπορεί να προκύψει στο σκάφος ή και τους επιβαίνοντες με Ασφάλιση Σκάφους. Ευχαριστήσου κάθε στιγμή με την εγγύηση της Generali.

Φρόντισε τα έργα τέχνης ή κάθε πολύτιμο αντικείμενο που έχεις στην κατοχή σου. Προστάτεψε την επένδυσή σου, νιώθοντας σίγουρος πως ό,τι αγαπάς προστατεύεται πλήρως από κάθε πιθανό κίνδυνο, με ευρεία επιλογή καλύψεων και άμεση διαδικασία αποζημίωσης.

Αξιοποίησε όλες τις δυνατότητες της ασφάλισής σου από ένα ενιαίο σημείο πρόσβασης. Δες τις καλύψεις σου, υπόβαλε νέα αιτήματα αποζημίωσης και παρακολούθησε την πορεία τους βήμα- βήμα.

ΕΠΙΠΕΔΟ ΙΚΑΝΟΠΟΙΗΣΗΣ

ΕΠΙΠΕΔΟ ΙΚΑΝΟΠΟΙΗΣΗΣ4.1/5

δηλώνουν ικανοποιημένοι από τις υπηρεσίες μας

ΣΤΕΓΙΑ Μ

ΣΤΕΓΙΑ Μ ΑΡΤΕΜΙΣΙΑ Γ

ΑΡΤΕΜΙΣΙΑ ΓΗ αμεσότητα στην εξυπηρέτηση